Deutsche Bank on Twitter: "#dbresults Deutsche Bank's strong balance sheet provides a solid foundation for growth: Common Equity Tier 1 (CET1) ratio of 13.6% and high liquidity reserves https://t.co/3Fk9dV7O2Y https://t.co/opP2mvgBUg" / Twitter

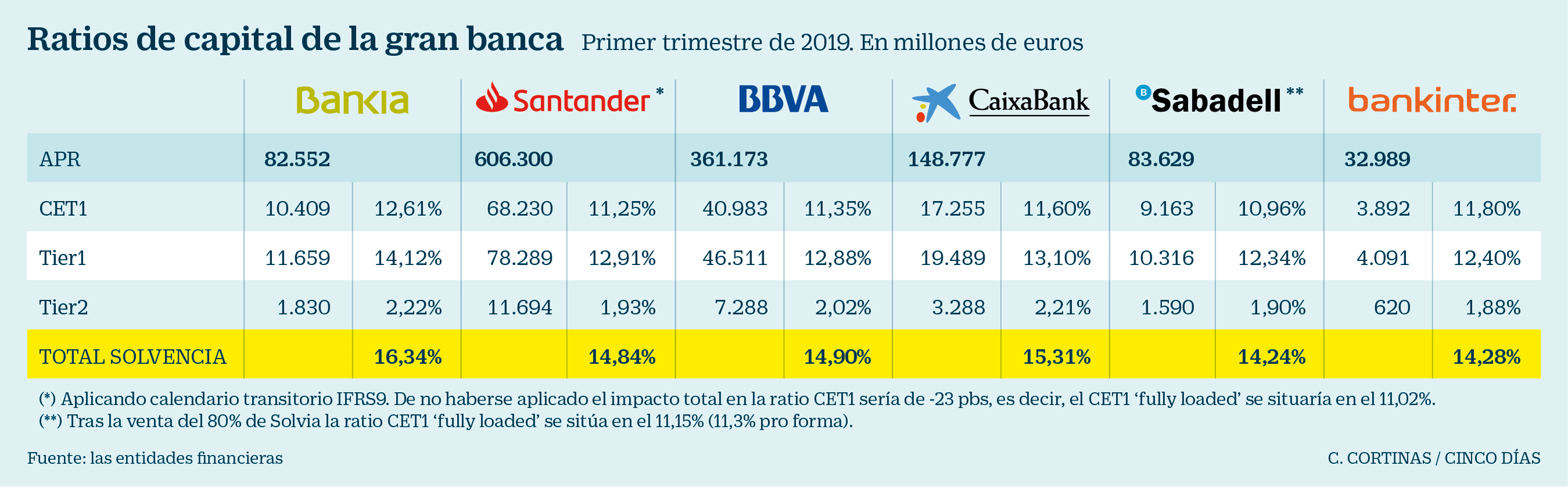

Bankia es el único gran banco español que supera el 12% de ratio de capital | Compañías | Cinco Días

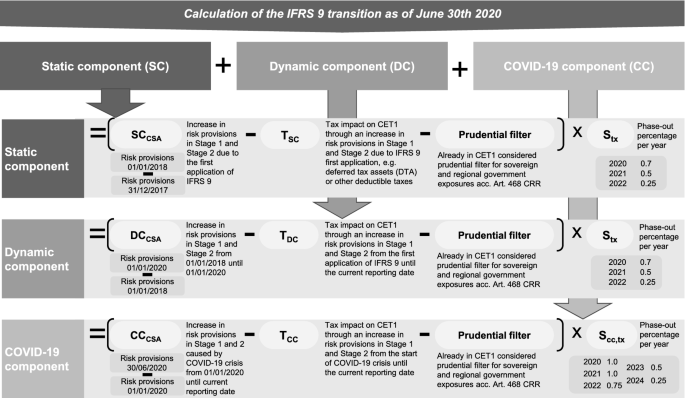

The effectiveness of IFRS 9 transitional provisions in limiting the potential impact of COVID-19 on banks | SpringerLink

EBA publishes the results of its 2021 EU-wide stress test | EBA publishes the results of its 2021 EU-wide stress test | Better Regulation

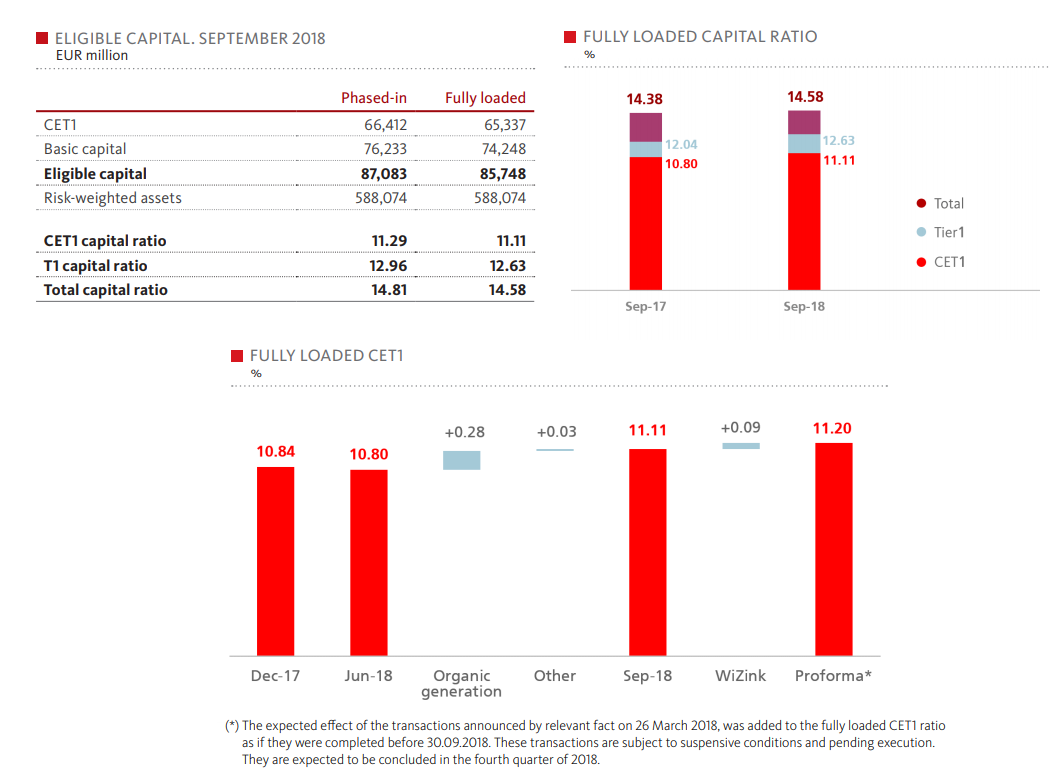

Banco Santander: A 5.5B EUR Capital Deficit In The Stress Test Adverse Scenario Isn't A Big Issue (NYSE:SAN) | Seeking Alpha